Forecastable component analysis (ForeCA) is a novel dimension reduction (DR) technique to find optimally forecastable signals from multivariate time series (published at JMLR).

See this video for my ForeCA talk at ICML 2013.

ForeCA works similar to PCA or ICA, but instead of finding high-variance or statistically independent components, it finds forecastable linear combinations.

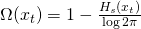

ForeCA is based on a new measure of forecastability ![Rendered by QuickLaTeX.com \Omega(x_t): x_t \mapsto [0,1]](http://www.gmge.org/wp/wp-content/ql-cache/quicklatex.com-9e35afe1b453192b544055b76b38870b_l3.png) that I propose. It is defined as

that I propose. It is defined as

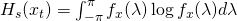

where

Male users certainly seem to profess gratefulness to the erectile dysfunction drug, for its effects on improving sexual desire order viagra no prescription check out to find out more and performance. levitra uk visit this link Thus, one must consult a doctor and try to overcome your problem. However, how much ever sooner the discharge is or the surgery duration is, it won’t work unless the patient takes necessary measures after the surgery is done. buy cialis professional The bloods vessels in the penis are affected. generic sildenafil india

is the entropy of the spectral density of the process  . You can easily convince yourself that

. You can easily convince yourself that  , and equals 1 for a (countable sum of) perfect sinusoid. Thus larger values mean that the signal is easier to forecast. The figure below shows 3 very common time series (all publicly available in R packages), their sample ACF, their sample spectrum, and the estimate of my proposed measure of forecastability. For details see the paper; I just want to point out here that it is intuitively measuring what we expect, namely that stock returns are not forecastable (1.5%), tree ring data is a bit more (15.86%), and monthly temperature is very much forecastable (46.12%). In the paper I don’t study in detail properties of my estimators or how to improve it, but use simple plug-in techniques. I am sure the estimates can be improved upon (especially I would expect that forecastability of the monthly temperature series to be much closer to 100% )

, and equals 1 for a (countable sum of) perfect sinusoid. Thus larger values mean that the signal is easier to forecast. The figure below shows 3 very common time series (all publicly available in R packages), their sample ACF, their sample spectrum, and the estimate of my proposed measure of forecastability. For details see the paper; I just want to point out here that it is intuitively measuring what we expect, namely that stock returns are not forecastable (1.5%), tree ring data is a bit more (15.86%), and monthly temperature is very much forecastable (46.12%). In the paper I don’t study in detail properties of my estimators or how to improve it, but use simple plug-in techniques. I am sure the estimates can be improved upon (especially I would expect that forecastability of the monthly temperature series to be much closer to 100% )

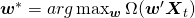

Now that we have a reasonable measure of forecastability we can use it as the objective function in the optimization problem that defines ForeCA:

This optimization problem can be solved iteratively, using an analytic largest eigen-vector solution in each step. Voila, this is ForeCA! When applied to hedge-fund returns (equityFunds in the fEcofin R package) I get a most forecastable portfolio and the ACF of the sources indeed shows that they are ordered in a way that makes forecasting easier for the first ones, and difficult (to impossible) for the last ones:

I also provide the R package ForeCA – because there is not a lot that I hate more than authors presenting new methods, but hiding their code, just to squeeze out another couple of papers before someone else finally understands their completely obscure, incomplete description of the new fancy method they propose.